March 26, 2024

Eyes4Research

The healthcare space is always changing, and understanding the perspectives and behaviors of physicians is crucial for pharmaceutical companies, medical device manufacturers, and healthcare providers alike. Market research with physicians offers invaluable insights that drive product development, marketing strategies, and patient care improvements.

However, conducting research with physicians presents unique challenges that require innovative solutions. Here, we’ll explore some of these challenges and discuss how custom online panels can be instrumental in overcoming them effectively.

Limited Time Availability

Physicians are notoriously busy professionals, often juggling patient appointments, administrative tasks, and continuing education requirements. Traditional research methods such as in-person interviews or focus groups, can be challenging to schedule and may disrupt physicians’ already packed schedules.

Custom online panels, such as the ones created and managed by Eyes4Research, offer a convenient solution by allowing physicians to participate in research activities at their own pace and on their own time, minimizing disruptions to their busy schedules.

Access to Diverse Physician Specialties

Physicians represent a diverse range of specialties, each with its unique perspectives and insights. Recruiting a representative sample of physicians across various specialties can be difficult using traditional recruitment methods.

Custom online panels enable researchers to access a broader and more diverse pool of physicians, ensuring that insights are reflective of the entire medical landscape. At Eyes4Research, our Physician panel represents a wide range of specialties, including Family Medicine, Immunology, Cardiology, Primary Care, and many more.

Geographic Reach

Physicians are located across a variety of geographic regions, ranging from urban centers to rural communities. Conducting research with physicians scattered across different locations can be logistically challenging and costly.

Depending on where the research is being conducted, there can be differences in data collection, due to factors such as the geopolitical climate, environmental realities, and cultural variations that need to be considered.

For instance, conducting research in the U.S. and Canada requires researchers to connect with local and regional authorities to secure any necessary permits. A short list of some of the possible types of organizations researchers might need to contact includes hamlet or community council offices, indigenous representatives, and any local research institutes.

Both the U.S. and Canada have regions that are home to indigenous peoples and gaining insights from physicians in those regions would be crucial to any research project.

Custom online panels break down geographic barriers, allowing researchers to engage with physicians from across the country or even internationally, without the need for extensive travel or the type of logistical coordination outlined above.

Our Physician panel has a custom sample of over 300,000 healthcare professionals from around the globe who are authentic, well-screened, and ready to participate in our clients’ research projects.

Compliance and Privacy Concerns

Physicians are bound by strict regulations regarding patient privacy and data security. Traditional research methods may raise concerns about confidentiality and compliance with regulatory requirements.

Custom online panels provide a secure and compliant platform for data collection ensuring that any sensitive information is handled with the utmost care and confidentiality.

Custom online panels offer a versatile and efficient solution for overcoming the challenges associated with conducting market research with physicians. By leveraging an online panel managed by Eyes4Research tailored to the unique needs of healthcare researchers, companies can accomplish the following:

Custom online panels present a powerful tool for navigating the complexities of market research with physicians. By embracing innovation and leveraging technology, healthcare organizations can unlock valuable insights that drive success in an increasingly competitive healthcare arena.

Read more about the healthcare industry and how your company can harness the power of online panels on the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights in the healthcare space. Our panels are comprised of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our specialty panels here.

February 27, 2024

Eyes4Research

The cannabis industry has experienced a whirlwind of changes in recent years. From legalization movements sweeping across various parts of the U.S. to the emergence of new products and consumption methods, the landscape of the cannabis market has been dynamic. However, amid all the hype and excitement, there’s a lingering question: Is the cannabis industry experiencing a decline, or has it simply reached a plateau?

Understanding the Current Cannabis Landscape

The initial boom of the cannabis industry was fueled by optimism and high expectations. As legalization efforts gained traction in different parts of the world, investors poured funds into cannabis-related ventures, and consumers eagerly explored a plethora of products ranging from recreational to medicinal. This surge in interest led to exponential growth and a seemingly boundless potential for the industry.

Are There Signs of Saturation in the Cannabis Industry?

However, as the industry matured, certain challenges became apparent. Regulatory hurdles, oversupply issues, and fierce competition have presented significant obstacles for businesses operating in the cannabis space.

Market saturation, especially in regions where legalization occurred early on, has led to price wars and squeezed profit margins for many companies. Moreover, shifting consumer preferences and the emergence of alternative products have added further complexity to the market dynamics.

Plateau or Decline?

The question of whether the cannabis industry is on a downward trajectory or has simply reached a plateau is a nuanced one. While some market segments may be experiencing a slowdown, others continue to show promise and resilience.

For instance, the medicinal cannabis sector continues to expand as more research validates its therapeutic potential and as regulatory frameworks become more accommodating.

What is the Role of Market Research in Understanding the Cannabis Industry?

In navigating these uncertain waters, reliable data and insights are more crucial than ever. This is where custom online panels, such as the ones created and managed by Eyes4Research, can make a difference.

By leveraging the power of digital platforms, custom online panels allow businesses to collect real-time feedback from targeted demographics and key stakeholders within the cannabis industry.

Whether it’s understanding consumer preferences, tracking market trends, or evaluating the efficacy of marketing strategies, custom online panels offer a cost-effective and efficient solution for staying ahead of the curve.

Why Choose Online Panels?

Custom online panels enable businesses to tailor their research initiatives to accommodate specific objectives and demographics, ensuring that the insights gained are actionable and relevant.

With customizable survey designs and access to diverse participant pools, businesses can gain deeper insights into consumer behaviors, preferences, and attitudes toward cannabis products. In addition, the scalability of online panels allows for seamless expansion into new markets and the ability to track evolving trends over time.

The future of the cannabis industry remains uncertain, but one thing is clear: staying informed and adaptive is the key to success in this rapidly evolving market. By leveraging online panels, businesses can gain the insights needed to navigate challenges, identify opportunities, and stay ahead of the competition.

Whether the industry is experiencing a decline or a plateau, those who invest in understanding their target audience and market dynamics will be well-positioned to thrive in the ever-changing world of cannabis.

Read more about cannabis consumers and cannabis products on the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights from cannabis users. Our panels are comprised of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our cannabis user panel and our other specialty panels here.

February 21, 2024

Eyes4Research

The advertising industry constantly evolves, and understanding consumer behavior and preferences is paramount for success. Advertising agencies are crucial in crafting campaigns that resonate with target audiences. However, agencies must prioritize effective market research initiatives to truly excel in this space.

Let’s dive into the significance of market research for advertising agencies and learn more about why these agencies should consider integrating online panels into their strategies.

Understanding Consumer Dynamics

Consumer behavior is dynamic, and influenced by various factors such as socio-economic trends, cultural shifts, and technological advancements. To stay ahead in the competitive advertising arena, agencies need to decipher these complexities effectively.

Traditional research methods, such as focus groups and surveys have their place for certain, but often fall short in capturing real-time insights.

The Need for Comprehensive Research

While advertising agencies have historically relied on conventional market research techniques, the ever-changing digital era demands a more agile and data-driven approach. In this environment, decisions need to be informed by up-to-the-minute data and insights. Here is where custom online panels emerge as a game-changer for advertising agencies.

The Power of Online Panels

Online panels offer a dynamic platform for conducting market research with unparalleled efficiency and depth. By leveraging online panels, such as the ones Eyes4Research creates and manages for our advertising agency clients, agencies gain access to diverse pools of respondents representing various demographics, geographies, and psychographics. This diversity enables advertising agencies to conduct targeted research tailored to specific client needs.

What Are the Key Advantages of Online Panels for Advertising Agencies?

The world we live in is hyper-connected, and the success of advertising campaigns hinges on the ability of advertising agencies to understand and adapt to evolving consumer dynamics. By embracing online panels as a cornerstone of their market research strategy, advertising agencies can unlock a wealth of insights, enhance campaign effectiveness, and stay ahead in an increasingly competitive landscape.

Advertising agencies that leverage the power of online panels will elevate their market research efforts to new heights and be rewarded with higher-quality consumer insights and more effective campaigns.

Online panels are powerful tools that provide a more affordable way for advertising agencies to collect valuable data to determine the value of their brand’s product or service. Eyes4Research has everything your company needs to collect high-quality insights from consumers. Our panels are comprised of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our online panels here.

November 27, 2023

Eyes4Research

In recent years, integrating STEM subjects into education has sparked a revolution in learning methodologies. This transformation has reshaped the educational landscape and created a ripple effect on the future workforce and technological advancements.

STEM integration in education goes beyond teaching individual subjects; it cultivates critical thinking, problem-solving skills, and innovation. By intertwining these disciplines, students are encouraged to think more holistically, encouraging a mindset that aligns with the demands of an ever-evolving world.

One crucial aspect of maximizing the benefits of STEM integration lies in understanding its impact through comprehensive market research. Custom online panels, such as the ones created and managed by Eyes4Research, serve as a powerful tool, offering a tailored approach to gain insights from diverse stakeholders in the education sphere.

Custom online panels enable researchers to engage with educators, administrators, students, and parents, creating a platform for inclusive feedback. By leveraging these panels, researchers can delve deeper into understanding the effectiveness of STEM integration strategies, identifying challenges faced by educators, and gauging students’ enthusiasm and comprehension.

The agility and adaptability of online panels allow for exploring emerging trends and the continual evolution of various educational methodologies. They facilitate the collection of real-time data, empowering educators and policymakers to make informed decisions that nurture an environment that is conducive to STEM learning.

In addition, custom online panels offer a cost-effective and time-efficient approach to collecting both qualitative and quantitative data. This method ensures a comprehensive understanding of the multifaceted aspects of STEM integration, allowing for targeted interventions and improvements.

As consumers navigate an increasingly technology-driven world, the integration of STEM into education stands as a symbol of progress. Leveraging custom online panels supercharges our ability to understand, adapt, and optimize STEM education, ensuring that future generations are equipped with the skills needed to thrive in a dynamic, tech-focused landscape.

The combination of STEM subjects with education is transformative, and the use of custom online panels is instrumental in fully understanding its impact. By harnessing the power of these panels, we can create an educational landscape that encourages innovation, and critical thinking, and prepares students for the challenges and opportunities of the future.

Stay current on the changing education landscape with the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights from educators. Our panels are made up of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our specialty panels here.

September 12, 2023

Eyes4Research

When the World Wide Web became publicly available in 1991, it revolutionized the way we work and play and perhaps more importantly how we consume information and goods. The early internet was relatively primitive and boring, but it soon evolved to be dominated by ecommerce and then social media platforms. Many tech and business experts believe that we are at the precipice of a new internet era, often referred to as “Web3,” for the third iteration of the internet. Proponents say that Web3 will be a decentralized internet that runs on blockchain technology, and brands that know how to utilize it to connect with their consumers will gain an advantage in the new tech-driven economy.

Gavin Wood, the founder of proof-of-stake cryptocurrency Polkadot and cofounder of Ethereum, first coined the term Web3 in 2014 to describe the increasingly decentralized internet based on blockchain technology, which he helped to create. Obviously, the definition is a bit broad and open to interpretation to a certain extent, so in the subsequent years others have added to Wood’s definition. As technology has advanced since 2014, and more people have become familiar with blockchain technology, other important elements of Web3 that’ve been identified are its trustless nature – which may sound negative, but in this context it’s not and will be explained more later – and users/consumers control over their personal information.

The trends suggest that although there are many barriers to the complete adoption of Web3, where it is adopted, investors, brands, and consumers will reap incredible benefits. Consumers will enjoy the control they will gain over their personal data, while brands will find new ways to connect with their loyal consumers. So let’s take a look at how Web3 started, where it is today, and how consumers can expect from this new iteration of the internet.

How the Internet Became Web3

Tech experts generally divide the history of the internet into three phases. The first phase, known as Web 1.0, includes the period from just before the World Wide Web went public in 1991 to 2004. This era of the internet was marked by static web pages that were primarily informational and not interactive, although some of the earliest ecommerce sites, such as Amazon, began during this era. The second era, Web 2.0, began in the mid-2000s with the growth of social media, blogs, and ecommerce. The internet became much more interactive and the technology was driven by smartphones and cloud computing. As blockchain technology became more widespread by the late 2010s, experts have argued that we entered the latest version of the internet around that time.

As we enter this new internet paradigm, its success will depend on its widespread adoption, which will largely be contingent upon how well consumers understand the technology. Web3 will be based on blockchain technology, which may sound complex at first but it’s really straightforward. Blockchains are online storage systems that use encryption and distributed computing to protect the data stored on them. Encryption gives only limited people access to the data, while the distributed or decentralized element means that shards of data need to match in order for data packets to be retrieved or transactions to take place. In theory, and so far in practice, this form of internet creates a “trustless” format, whereby users are not forced to trust a company or central authority to protect their data or ensure that transactions are legitimate. Blockchain technology has opened an array of opportunities for investors and consumers, some of which are currently being realized.

Real World Web3 Applications

Cryptocurrencies have led the transition to Web3, with Bitcoin, the world’s first cryptocurrency being released on January 9, 2009. Bitcoin’s potential application for Web3 investors and consumers were quickly realized, as it remains the number one cryptocurrency by market cap because of its utility as money, a store of value, and as a financial instrument. But as much as Bitcoin may’ve opened the Web3 door, it’s the number two cryptocurrency by market cap, Ethereum, which will likely play a bigger role in the new internet paradigm.

The Ethereum blockchain has proven to be highly adaptable and a destination for businesses and consumers who use Web3. Everyday new “tokens” are being created that allow users to access the Ethereum blockchain for decentralized finance, smart contracts, and non-fungible tokens (NFTs). NFTs are digital art that are “minted” as originals and stored on the blockchain. As strange as the concept of NFTs may seem to many, they’re gaining in popularity and market cap. Investment bank Jefferies that NFTs will have a market value of over $85 billion by 2025.

Smart contracts, decentralized finance (DeFi), and decentralized autonomous organizations (DAOs) will also play a role in the emerging world of Web3. Smart contracts are contracts that are stored on a blockchain and can only be completed or fulfilled when certain requirements are met, while DAOs are companies that are bound by rules coded into the blockchains they use. These two concepts are combined when DAOs store data, such as retail prices, and contracts with wholesalers on blockchains, with the advantage being they are invulnerable to standard hackers.

When DAOs and traditional companies use blockchains for business purposes, it is referred to as decentralized finance (DeFi). DeFi can include person-to-person or company-to-company transaction, with the primary benefit being that banks are bypassed. Although transaction fees are part of every blockchain transaction, they are often small and consumers only pay for the transactions they make. As more consumers are learning the ropes of Web3 and blockchain technology, companies and brands are starting to pay attention.

Some Brands That Have Adopted Web3 and DeFi

Due to the nature of Web3, it isn’t immediately apparent how many brands have adopted the new internet paradigm, but a quick look reveals that it is catching steam. Microsoft, AT&T, and Overstock.com have all begun accepting crypto for bill and merchandise payments, perhaps acting as the vanguard of DeFi and Web3 adoption among major brands. But a number of lesser known companies are also making inroads in the world of Web3.

Among the brands using Web3 and DeFi to watch out for the in coming years are the blockchain based social platform, Steemit, and the blockchain based supply chain, Everledger. Another company to follow is the decentralized exchange trading market, Augur. The reason why these three companies are potentially poised for success is because they all combine the new technology of Web3 with goods and services current consumers want.

Future Trends and Consumer Benefits of Using Web3

There’s no doubt that Web3 adoption will set the tone for technology advances in the coming decades, but brands that know how to utilize it, such as those mentioned earlier, will use it to connect with their consumers. The trustless element of blockchain technology gives plenty of freedom to the consumer in many different ways. For example, consumers will be able to trade online apps on blockchains using smart contracts, cutting out the middleman in the process. Web3 also has the ability to give consumers more control over their data.

Under the current internet paradigm, personal data is stored on servers that are vulnerable to hackers, but on Web3, data can be stored on blockchains that can only be released if the owner allows it. In addition to enhanced security, blockchain data storage will cut down on spam and those who use it will be able to say goodbye to third party cookies forever!

One of the most important future trends of Web3 will be how it connects brands with its consumers, by building more trust and loyalty. Because 76% of consumers don’t know what companies are doing with their personal data, the adoption of Web3 gives brands an opening. Perhaps somewhat ironically, the trustless aspect of the blockchain can provide a way for brands to rebuild trust with their customers, although it will require consumers to adopt the new technology. Brands can also leverage the new technology in other unique ways to build customer loyalty.

Nike has recently combined blockchain technology and the metaverse – which is considered another part of Web3 – to sell virtual sneakers in the virtual world, Roblox. Fashion brand Dolce & Gabbana recently combined the metaverse and NFTs to connect with its consumers by auctioning a nine-piece collection of NFTs for $6 million, which included a suit that the auction winner can wear in the metaverse. Brands can also issue NFTs and/or blockchain tokens as a way for their consumers to access special online events or deals, ultimately replacing standard loyalty points.

How well brands migrate loyalty rewards programs to Web3 will likely play a much bigger role in the retail space in the future, giving consumers more power over how they store and use those points. An average consumer is enrolled in 18 loyalty programs, but they are only actively engaged in less than half of them, meaning lost points for the consumer and fewer chances for brands to engage their customers. Web3 technology can bring customer loyalty programs to the next level by offering digital rewards that are uniquely ownable, tradeable, and collectable, transforming brand-customer transactions into a more immersive experience.

Of course the adoption of Web3 faces some barriers. Most of the big tech companies have no incentive to give up the power they hold over Web 2.0 and the current US government is hostile- to crypto generally and appears to know little, or care, about blockchain technology’s wider uses. Consumers are also slow to learn about what many perceive as an arcane form of technology, but many of these barriers existed before other major technology revolutions throughout history. Web3 may not replace the current iteration of the internet overnight, but brands that recognize its value as a tool to connect with consumers will find that it will be useful in the coming years.

About the author:

An industry leader and influencer – Rudly Raphael specializes in all aspects of research logistical design involving quantitative methodology, implementing internal system infrastructure to streamline business processes, channelling communication and developing innovative research solutions to ensure Eyes4Research remains a competitive force in the marketplace. An entrepreneur, inventor (patent holder), blogger and writer – his articles have been published in various magazines such as Medium, Ebony Magazine, Bussiness2Community and also cited in various journals and academic publications.

August 16, 2023

Eyes4Research

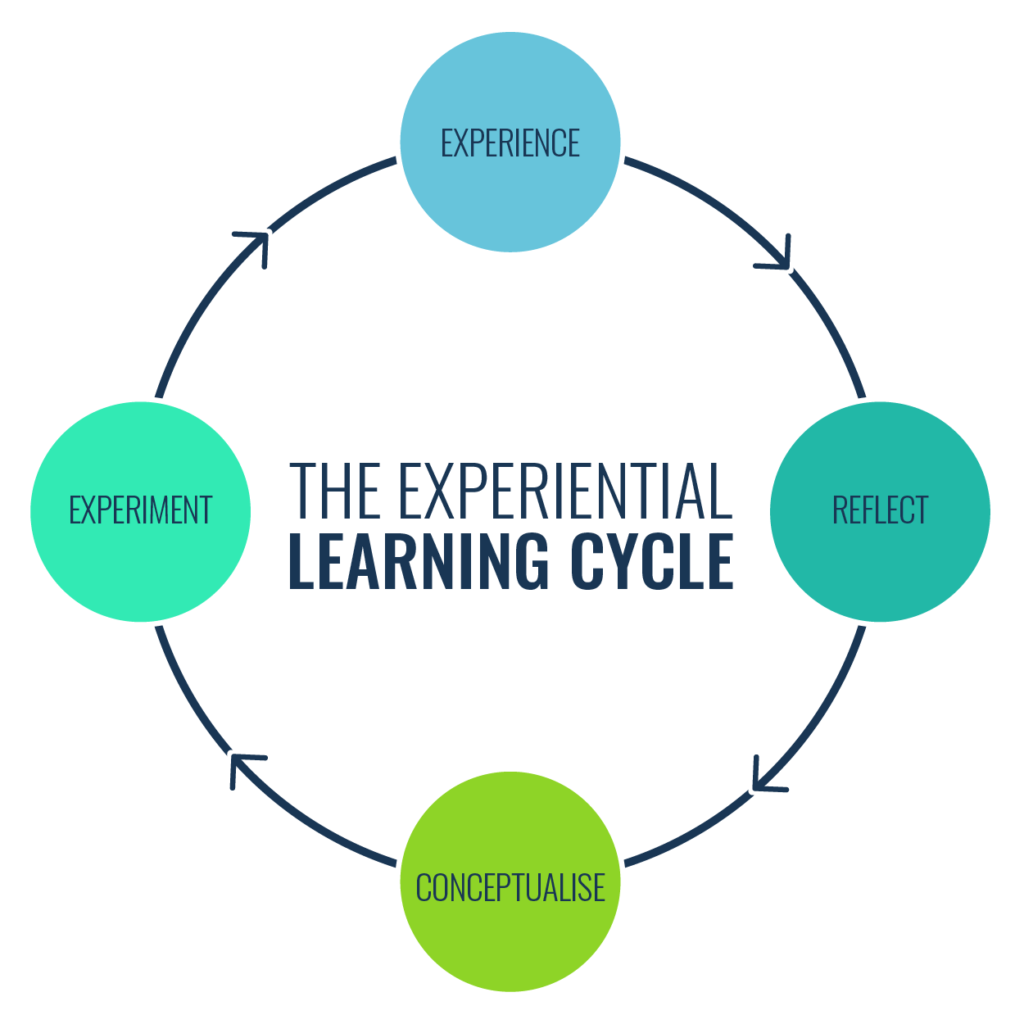

Experiential learning has emerged as a powerful approach to education, revolutionizing the traditional classroom experience. Unlike passive learning methods, such as lectures and textbooks, experiential learning actively engages students through hands-on experiences and real-world challenges.

Here are 4 reasons why experiential learning is important and why it is having a transformative impact on encouraging critical skills, fostering deeper understanding, and preparing students for success.

Active Engagement and Immersive Learning

Experiential learning places students at the center of their own education, enabling them to actively participate in the learning process. By immersing themselves in practical activities, students develop a deeper understanding of the subject matter.

This hands-on approach encourages curiosity, creativity, and problem-solving skills, allowing learners to connect theory to real-life situations and apply their knowledge effectively.

Fostering Critical Skills

Experiential learning goes beyond memorization; it nurtures a range of critical skills essential for personal and professional growth. Communication, teamwork, adaptability, and leadership skills are honed as students collaborate and tackle challenges together.

Additionally, experiential learning builds resilience and self-confidence, empowering learners to embrace failures as valuable learning opportunities.

Real-World Relevance

Traditional education often struggles to convey the practical applications of theoretical knowledge. Experiential learning bridges this gap by exposing to authentic, real-world scenarios.

Whether through internships, field trips, simulations, or project-based learning, students gain insights into how their academic learning aligns with the complexities of the world around them. These types of relevant lessons ignite a love of learning and a sense of purpose in students, inspiring them to make meaningful contributions to society.

Enhanced Retention and Long-Term Learning

Studies have shown that experiential learning significantly improves information retention compared to passive learning methods. When students actively participate in their education, they form lasting memories and a deeper understanding of the subject matter. This retention extends beyond exams and empowers students to apply their knowledge long after leaving the classroom.

Experiential learning is an exciting innovation in education, transforming the way we teach and learn. Its emphasis on active engagement and real-world relevance shapes students into well-rounded and adaptable individuals.

Stay current on the changing education landscape with the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights from educators. Our panels are made up of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our specialty panels here.

August 14, 2023

Eyes4Research

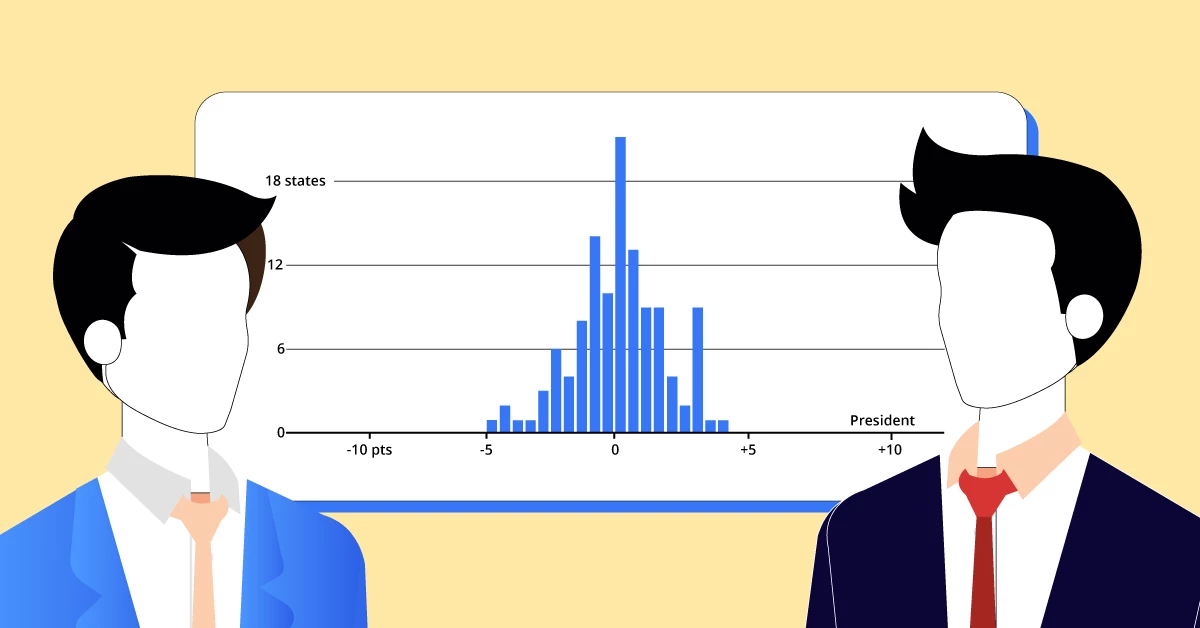

Polling has been an integral part of politics and decision-making for decades. However, it is not uncommon to witness pollsters facing criticism and being called out for inaccuracies in their predictions. While they utilize sophisticated methodologies, the question remains: why do they often get it wrong? What are the key factors that contribute to the pitfalls of polling?

Sampling Bias

One of the primary reasons behind the inaccuracies of polls is sampling bias. If the sample collected is not representative of the entire population, the results will be skewed. Achieving a truly random sample can be challenging, as certain groups may be underrepresented or difficult to reach, leading to distorted outcomes.

Methodological Errors

Pollsters employ various methodologies, such as phone surveys, online polls, or face-to-face interviews. The choice of method can influence the results, and even subtle variations in the wording of questions or in the design of surveys may introduce biases. Methodological errors can lead to misinterpretations and predictions that do not reflect reality.

Nonresponse Bias

Low response rates can plague pollsters’ efforts, as those who decline to participate in surveys may differ significantly from those who do respond. Nonresponse bias can skew the results and create an inaccurate reflection of public opinion.

Timing and Momentum

Polls are snapshots of public sentiment at a specific moment in time. Political landscapes are dynamic, and events can dramatically impact voter behavior. If polls are conducted too early or too late, they may not capture the most relevant insights, making them susceptible to inaccuracies.

Social Desirability Bias

Respondents might provide answers they believe are socially acceptable or expected, rather than their genuine opinions. Social desirability bias can be particularly significant in controversial or sensitive topics, leading to unreliable data.

Uncertainty and Margin of Error

Polls inherently involve a degree of uncertainty and the margin of error accounts for this variability. However, pollsters and the media often present poll results as definitive predictions, ignoring the potential for error and leading to misconceptions about the accuracy of the data.

Pollsters play a crucial role in shaping public opinion and political decisions. But they face formidable challenges that can lead to inaccuracies in their predictions. Addressing these challenges are essential steps to improve their accuracy.

As voters, it is important to recognize that polls are just snapshots in time and not crystal balls for election outcomes. By understanding the limitations of polls, voters can make more informed interpretations of poll voters and avoid being influenced by unrealistic expectations.

Read more about the market research industry on the Eyes4Research blog. The Eyes4Research voter panel provides academic researchers, pollsters, and campaign managers, among others, access to the first nationwide panel of likely voters to conduct online polling, as testing, focus groups, and in-depth interviewing among registered voters across the United States.

August 9, 2023

Eyes4Research

In recent years, the retail landscape has undergone a significant transformation, with subscription-based models emerging as a game-changer in the industry. Traditionally, consumers have been accustomed to one-off purchases, but now, a growing number of retailers are embracing subscription services to offer consumers convenience, personalization, and a steady revenue stream. Here are 6 reasons why consumers are seeing more subscription services on the market.

One of the primary reasons driving the surge in subscription-based models is the unparalleled convenience they offer to consumers. With a subscription, consumers can have products they love delivered to their doorstep regularly, without the hassle of reordering every time.

From beauty and fashion to groceries and pet supplies, this model caters to a wide range of industries, making consumers’ lives easier and more efficient.

In the era of information overload, consumers seek tailored experiences that align with their preferences. Subscription-based retailers leverage data analytics to understand their customers better, curating personalized product selections that cater to individual tastes.

This personalized touch creates a sense of exclusivity, making customers feel valued and understood.

For retailers, subscriptions offer a predictable and steady revenue stream, creating a more stable business environment. Rather than relying solely on seasonal fluctuations or one-time purchases, subscription models provide a reliable income source that can be used for strategic planning and business growth.

Subscription-based models encourage loyalty and commitment from customers. As users experience a seamless and rewarding shopping experience, they are more likely to stick with a brand long-term, leading to increased customer retention rates.

For new and innovative brands, subscription services provide an excellent platform for product discovery. By offering trail-sized products in subscription boxes, emerging brands can showcase their products to a targeted audience, gaining exposure and potential loyal customers.

Subscription models often promote sustainable practices. Sending products in bulk or utilizing eco-friendly packaging allows retailers to reduce their carbon footprint and contribute to a greener future. This aligns with the growing trend of consumers being increasingly aware of sustainability.

As the subscription model trend continues to evolve, retailers will need to adapt and innovate to meet the changing needs and expectations of their customer base. Offering seamless experiences and unique products gives retailers the opportunity to redefine the future of shopping and build lasting connections between brands and consumers.

Read more about the retail industry on the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights from consumers. Our panels are comprised of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our specialty panels here.

August 5, 2023

Eyes4Research

In our rapidly evolving digital age, content creation has become essential to our daily lives. Content creators wield significant influence over their audiences’ opinions, beliefs, and actions. With this power comes the responsibility to create content that is not only engaging but also ethical and responsible.

Here are 5 reasons why content creators need to produce content that is ethical and responsible for their audiences.

Ethical content creation is the foundation of building trust and credibility with an audience. When creators prioritize honesty, accuracy, and transparency, their followers are more likely to view them as reliable sources of information.

In a world where misinformation is commonplace, responsible content creation is crucial in encouraging informed discussions and combating the spread of falsehoods.

The internet has connected people from diverse backgrounds and cultures like never before. Ethical content creators understand the importance of respecting these differences and creating content that is inclusive and sensitive to various viewpoints. By doing so, they can contribute to a more understanding and compassionate online community.

Content consumption can significantly impact mental health, especially in the era of constant connectivity. Responsible content creators are mindful of the potential effects their content may have on their audience.

They aim to inspire, uplift, and educate rather than promote harmful behaviors or unrealistic standards. By promoting positivity and mindfulness, they play a role in helping to encourage a healthier digital environment.

Creating ethical content goes beyond entertainment; it can be a powerful tool for addressing social issues and driving positive change. Content creators who use their platform to advocate for important causes and promote social responsibility can mobilize their audiences to take action and create a collective impact.

Influencers and content creators are role models for many individuals, especially younger audiences. Responsible content creation means setting a positive example and being mindful of the influence they hold. By using their platforms to promote ethical values and responsible behaviors, they can inspire their followers to do the same.

Our interconnected world means that content creators have the potential to shape public opinion, influence behaviors, and impact society in significant ways. By being honest, respectful, and mindful of their impact, content creators can foster a digital landscape that promotes understanding, empathy, and positive change.

Consumers of content also play a role by supporting and engaging with creators who prioritize ethical and responsible practices and contributing to a healthier and more responsible digital experience.

Read more about media and marketing on the Eyes4Research blog. Eyes4Research also has everything you need to collect high-quality insights from consumers. Our panels are comprised of B2B, B2C, and specialty audiences ready to participate in your next research project. Learn more about our specialty panels here.

July 24, 2023

Eyes4Research

Currently, actors under the SAG-AFTRA union are on strike, which means not promoting their movie at events, appearing in any new roles, and many other things. But what are the specifics under their restrictions, why are they striking, and how does it connect to AI?

What is SAG-AFTRA?

SAG-AFTRA is a labor union that represents actors and general media professionals, helping them negotiate for better wages and working conditions in the event that they are unreasonable/unlawful. Not just big name millionaire actors, but small actors trying to break into the industry often find it beneficial to join unions for the reasons stated, and boycotting for higher wages benefits them more than it does the Matt Damons and Tom Cruises of the industry. The union was born in a merger of two established unions, the Screen Actors Guild (1933-2012) and the American Federation of Television and Radio Artists (1937-2012). SAG-AFTRA currently has upwards of 100,000 members.

Events Leading up to the Strike

Last month, under the conditions that their negotiating committee would not reach an agreement on their new contract with powerful Hollywood studios, SAG-AFTRA voted to go on strike. In late June, upwards of a thousand actors signed a letter threatening to strike, including A-listers like Rami Malek and Meryl Streep.

Negotiations that the union proposed to AMPTP (the Alliance of Motion Picture and Television Producers) included limiting the use of self-tape auditions (due to potential bias towards better camera and audio quality amongst audition participants) and issuing residuals for streaming viewership.

On July 14, the union announced at a press conference its decision to go on strike after their agreements were not met, following the laying out of details of the strike. This would be the first strike involving actors in the television and film industry since 1980.

AI in Film

One of the issues discussed in the strike was the use of AI-replicated digital likenesses of actors. A portion of the statement that SAG-AFTRA made depicting AMPTP’s stance on the issue (which the latter denies) is as follows, “We want to be able to scan a background performer’s image, pay them for a half a day’s labor, and then use an individual’s likeness for any purpose forever without their consent”. This caused outrage among many actors on social media, as the issue of appropriate payment for especially lower-ranking actors is one that has existed for a long time. Most entry-level actors don’t make nearly enough from one role to live off of, so many have to fit auditions, headshots, and other things in between one or two jobs.

This hit a nerve with a lot of people likely as a result of the increased use of AI in movies and TV shows, like the de-aging of some actors and the AI generated artwork in the opening title sequence in Marvel’s new show, “Secret Wars”. The ethical issue regarding AI art is a similar one, as many artists feel their art is being stolen from search engines to create this art, and some artists who do commissions express concern over the possibility of losing customers who want custom art commissioned. The attitudes of digital artists and actors are similar enough, both parties wanting to get full credit and payment for work they create.

Terms of the Strike

The terms of the strike that SAG-AFTRA proposed included actors not being able to promote their projects at film festivals or events, on social media, do interviews, and attend premieres. So pretty much any public promotion of films or shows from the actors is off the table.

Even promotional collaborations posted on social media have a disclaimer in their posts “filmed before the strike”. So, for however long this strike lasts, don’t expect to see any newly recorded media interviews with your favorite actors.

About the author:

Akili Raphael is a third-year student at DePaul University. He’s also an author and published his first book when he was only 10 years old. He is well versed in media topics such as animation, filmmaking, and is active in the online video game and sports communities. In his free time, he keeps his overflowing creativity in check by writing, creating art in various mediums, making short films, and practicing martial arts. Always interested in learning new things and sharing ideas, he considers himself a student of life above all else.